Preamble

I have heard every excuse expressed, from PUBLIC IGNORANCE to PUBLIC APATHY, concerning the deterioration of FREEDOMS in our United States. I cannot accept IGNORANCE because the public would have TO KNOW to ignore; nor can I accept APATHY for the same reason. It is my opinion that very few people would IGNORE or be APATHETIC towards the fact of their being slaves, in the positive sense, if they were ever exposed to that truth. It was introduced so gradually and with such surreptitiousness no one understood the change or was exposed to the significance of what was happening as truth became a scarce commodity.

The public used to own the medium of exchange. The medium of exchange was gold coin. The paper tokens we used to represent gold coin by proxy during exchanges was able to redeem gold coin and WE THE PEOPLE supported government and directed its policies, BUT:

Gold in the hands of the public is an enemy of the state.

Adolph Hitler

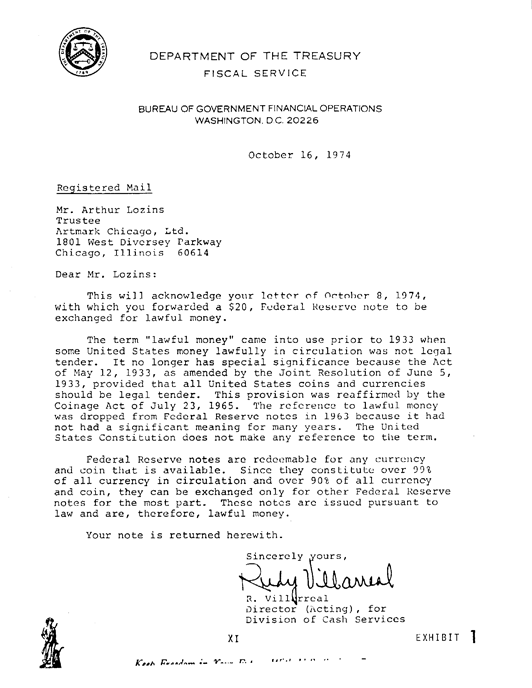

Study exhibit 1 to see the manner in which inquires, concerning our money, are handled by our officials. The term

later on; lawful money

came into use (2nd paragraph, 1st sentence) came into use …The reference to lawful money was dropped from Federal Reserve notes, But in paragraph 3 of exhibit 1 Mr. Vallarreal is saying Federal Reserve notes constitute 90% of all the money today and are

… lawful money

.

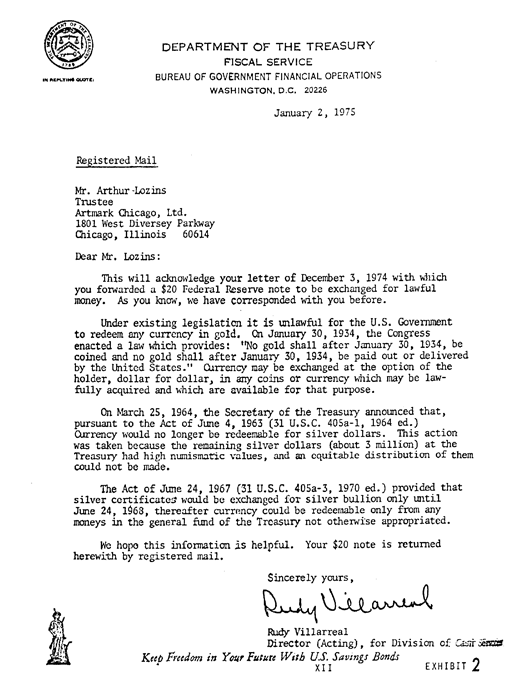

In exhibit 2 Mr. Vallarreal does not feel any discomfort to admit that gold coin was the lawful money. This will acknowledge your letter of December 3, 1974 with which you forwarded a $20 Federal Reserve note to be exchanged for lawful money. As you know, we have corresponded with you before.

Under existing legislation it is unlawful for the U.S. Government to redeem any currency in gold.

No equivocation at all; he asked for lawful money

and was answered: it is unlawful … to redeem … in gold.

Lawful money WAS gold coin current as money within the United States, but it is NOT NOW!

What took its place?

What is the modern money?

What amount of it is a dollar quantity?

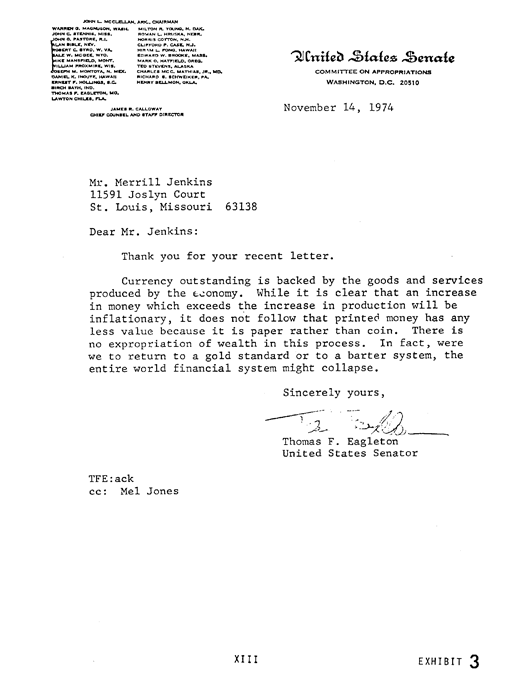

Congress tells us Currency outstanding is backed by the goods and services produced by the economy,

but the term backed

hides the fact that redemption in specie has been repudiated and the public’s production is being expropriated. See exhibit 3.

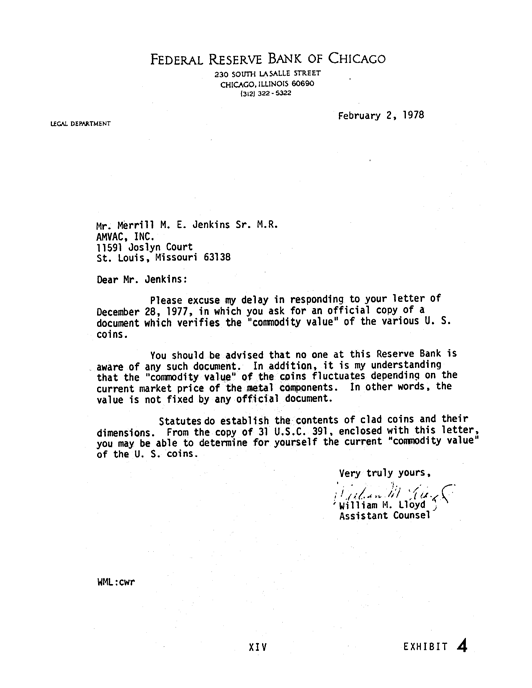

We are told that Congress sets the value of the money

they coin, but the only coins

in use now are copper-nickel and their value is not set by any official document.

(exhibit 4, 2nd paragraph, last sentence).

Take a simple thing like money, everybody uses money; everybody knows that dollar

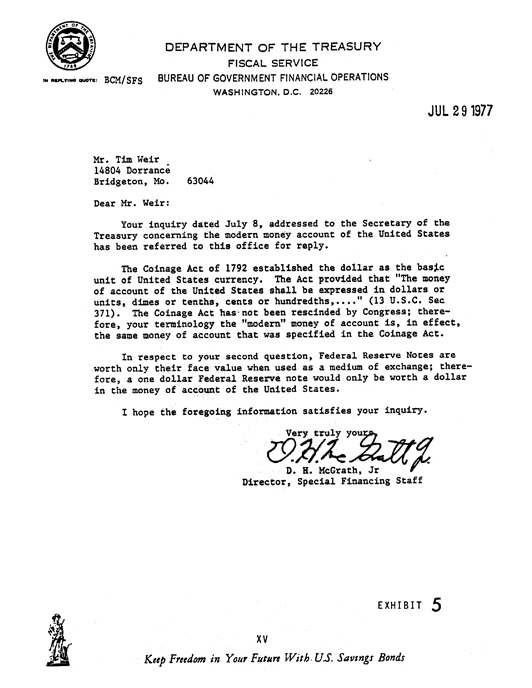

is a measurement of money, but no one seems to know what money is, today, or what amount of it is a dollar quantity. Study exhibit 5 the last word of the first sentence in paragraph two is currency

which everyone accepts as meaning money! The quote from the Coinage Act of 1792 says the money shall be expressed in dollars.

The letter conveys the thought that the money, today, which everybody accepts is Federal Reserve notes, is the same as in 1792, but the last paragraph speaks of a Federal Reserve note

as being WORTH a dollar of the money of account, NOT as a Federal Reserve note being the money of account, which is contradiction and confusion.

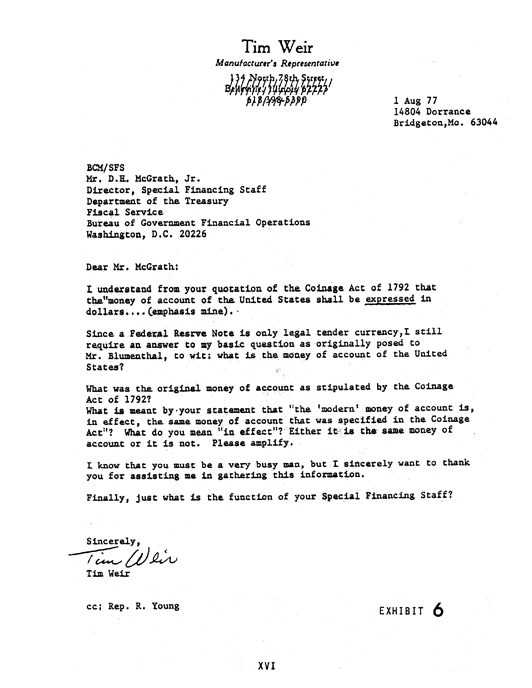

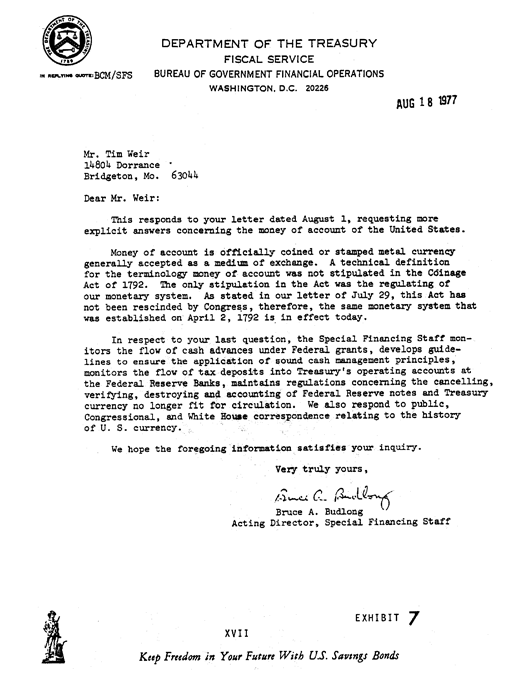

When questioned on this point (exhibit 6) the answer (exhibit 7) says: Money of account is officially coined or stamped metal currency … a technical definition for the terminology money of account was not stipulated in the Coinage Act of 1792.

That Act did, however, specify what quantity of gold and what quantity of silver as money should be a dollar

quantity and since only the money of account shall be expressed in dollar units it holds that gold and silver coin was the stipulated

money of account (… coined or stamped metal currency

) NOT PAPER!

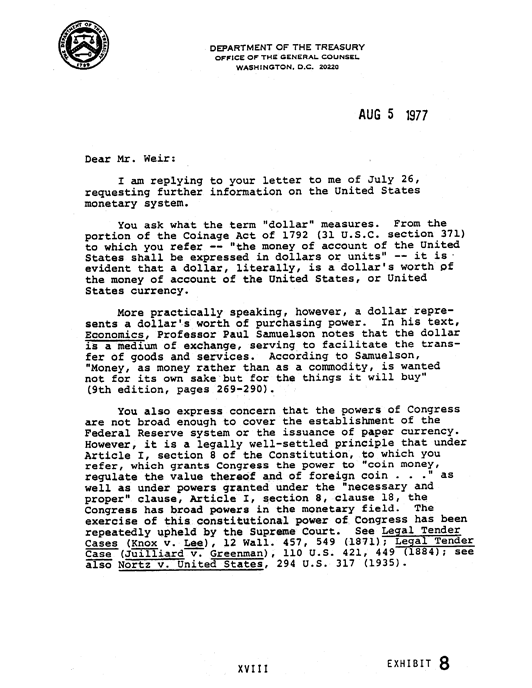

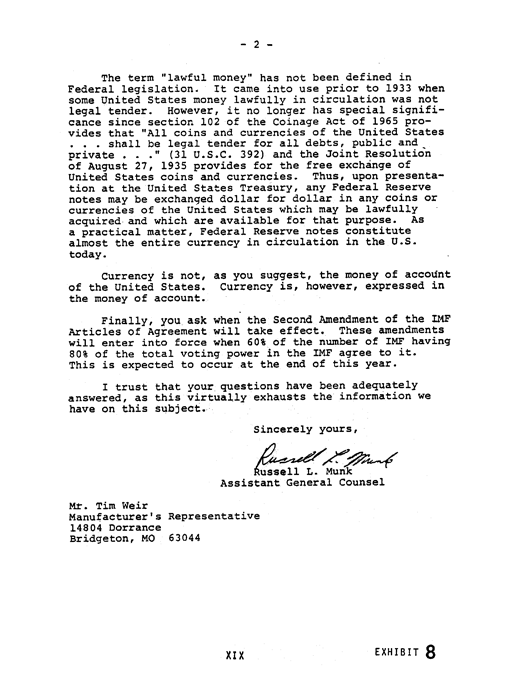

In exhibit 8 (page 1 | page 2) we find that a dollar, literally, is a dollar’s worth of the money of account of the United States, or United States currency.

However, currency is, as established above (exhibit 6) the answer (exhibit 7) coined or stamped metal gold or silver coins (gold and silver commodity coinage) which has not changed since 1792 (exhibit 5), but HAVE BEEN REMOVED from circulation, so the letter explains: Money, as money rather than as a commodity, is wanted …

What is money — that is not a commodity? Exhibit 8 continues (middle paragraph 4, page 1) … which grants Congress the power to

Please refer back again to exhibit 4; coin money, regulate the value thereof …

… the value is not fixed by any official document.

Exhibit 8 continues on page 2 The term

Why not? However, in exhibit 1, a few years earlier Mr. Rudy Vallarreal had no difficulty in declaring: lawful money

has not been defined in Federal Legislation.… notes are issued pursuant to law and are, therefore, lawful money.

Shortened: … notes are … lawful money

which is confirmed in exhibit 8 (page 2, last paragraph, last sentence) as a practical matter, Federal Reserve notes constitute almost the entire currency in circulation in the U.S. today.

Shortened: … Federal Reserve notes constitute currency.

But Federal Reserve notes are PAPER and exhibit 7 says again: Money of account is officially coined or stamped metal currency …

Exhibit 8 continues (page 2, paragraph 2, 1st sentence) states: Currency is not, as you suggest, the money of account of the United States.

Shortened: Currency is not … the money of account …,

but that is an absolute contradiction of exhibit 7 (2nd paragraph, 1st sentence) Shortened: Money of account is … currency …

Then insult is added to confusion injury (exhibit 8, page 2, Last paragraph) I trust that your questions have been adequately answered, as this virtually exhausts the information we have on this subject.

We are left with the same unanswered questions:

What is money today; what is modern money?

What amount of it is a dollar quantity?

However, if we return to the last sentence of paragraph 2 on page 2 of exhibit 8: Currency is, however, expressed in the money of account.

we are being led into considering that: Currency is … expressed in money …

Then currency is not money?

But since money is expressed in dollars that: the expression dollar

is the money?

But how can a WORD dollar

be the thing it measures?

AGAIN IF CURRENCY IS NOT … MONEY …

EXHIBIT 8, BUT MONEY … IS CURRENCY …

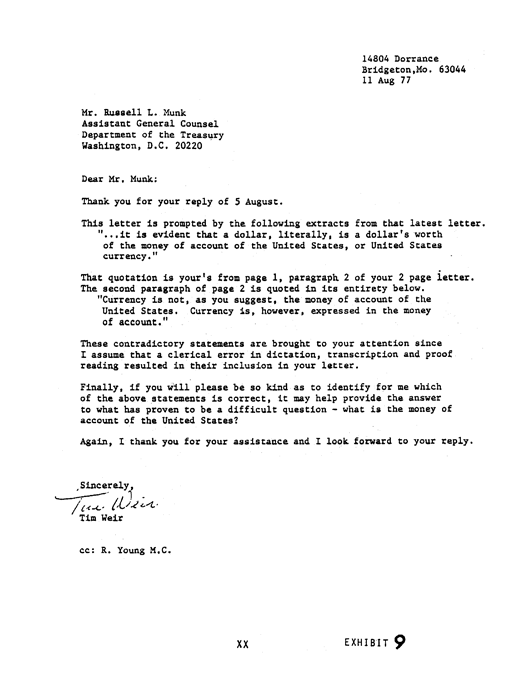

EXHIBIT 7 … it leads to exhibit 9 asking: … which of the above statements is correct, …

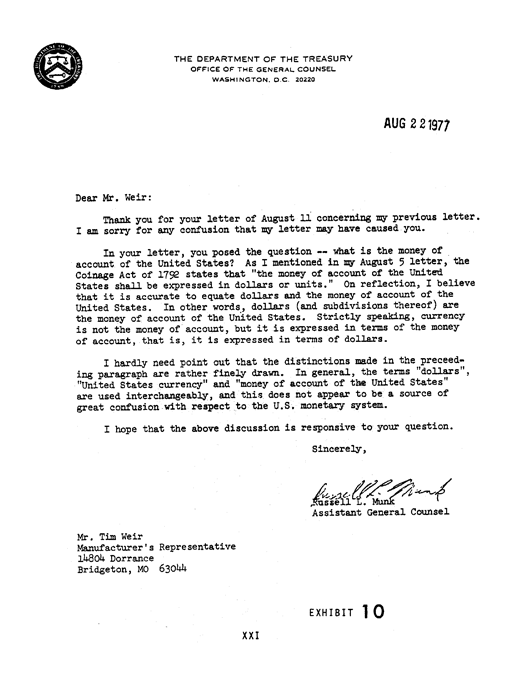

Exhibit 10 states in. other words, dollars (and subdivisions thereof) are the money of account of the United States. Strictly speaking, currency is not the money of account, but is expressed in terms of the money of account, that is, it is expressed in terms of dollars.

Shortened: … dollars … are … money … currency is not … money … but it is expressed … in … dollars.

In two sentences we have

- Dollars are money!

- Currency is not money!

- Currency is expressed in dollars!

But the Coinage Act of 1792, still in effect today (exhibit 7) IN exhibits 5 and 10 saying: The money of account of the United States shall be expressed in dollars …

Now we have:

- Notes are money! exhibit 1

- Gold is money! exhibit 2

- Goods and services are money! exhibit 3

- Money value is not fixed! exhibit 4

- Modern money is the same as in 1792! exhibit 5

- Money is currency! exhibit 7

- Currency is not money! exhibits 8 & 10

- Notes are currency! exhibit 8

- Money is expressed in dollars exhibit 5 & 10

- Dollars are money! exhibit 10

- Currency is expressed in dollars! exhibit 10

- Exhibit 1 & 2. Division of Cash Services Dept. of Treasury.

- Exhibit 3. United States Senate.

- Exhibit 4. Legal Dept. Federal Reserve Bank of Chicago.

- Exhibit 5. Special Financing Staff Dept. of Treasury.

- Exhibit 6. U.S. Citizen.

- Exhibit 7. Special Financing Staff Dept. of Treasury.

- Exhibit 8. Asst. General Counsel Fiscal Serv. Dept. of Treasury.

- Exhibit 9. U.S. Citizen.

- Exhibit 10. Asst. General Counsel Fiscal Serv. Dept. of Treasury.

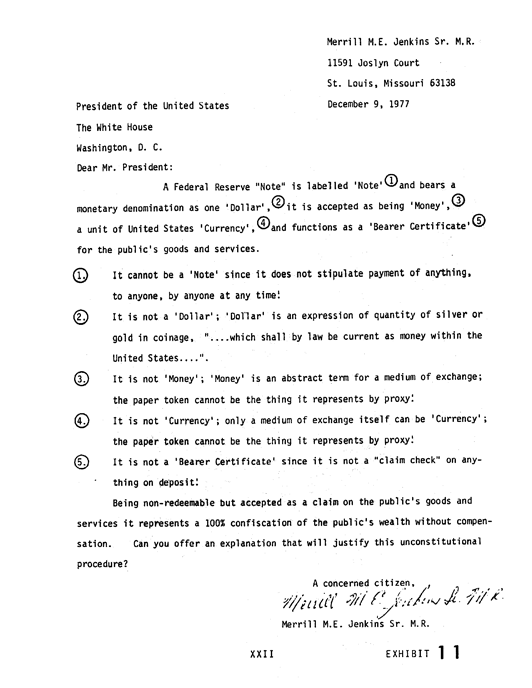

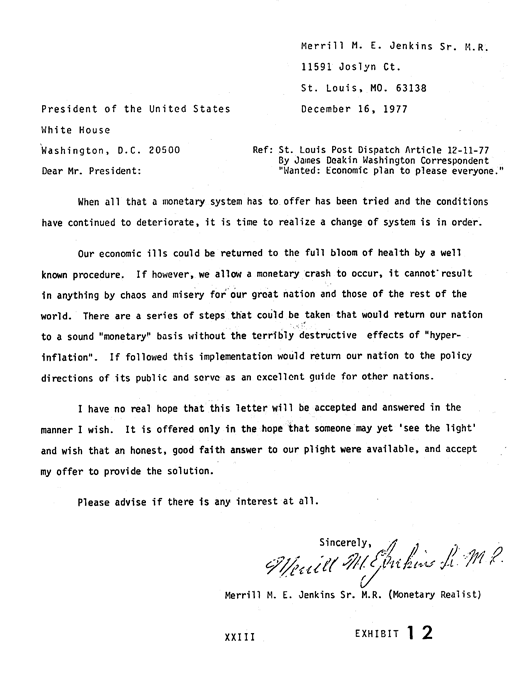

- Exhibit 11 & 12. To the President.

- Exhibit 13. From the White House.

- Exhibit 14. Some officials are helpful

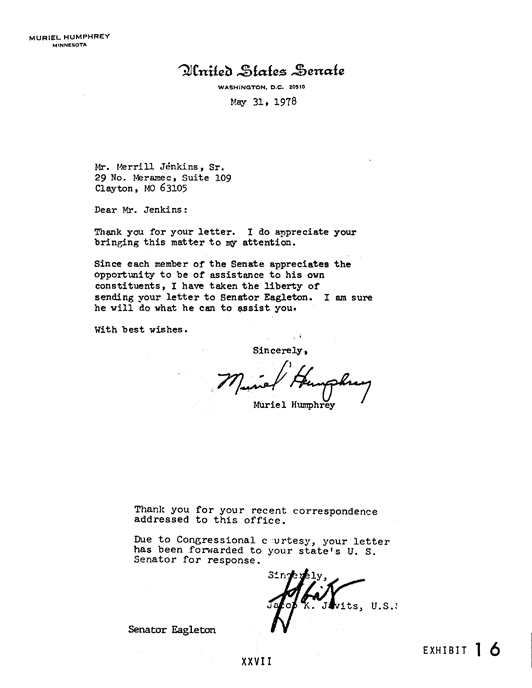

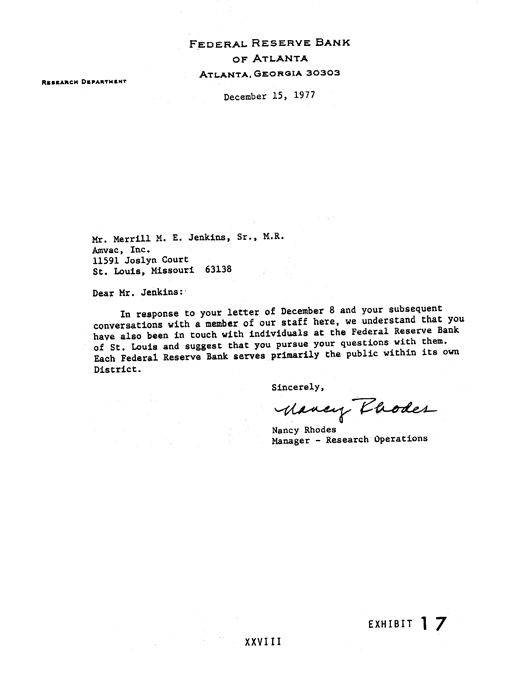

- Exhibit 15–16 & 17. others are not!

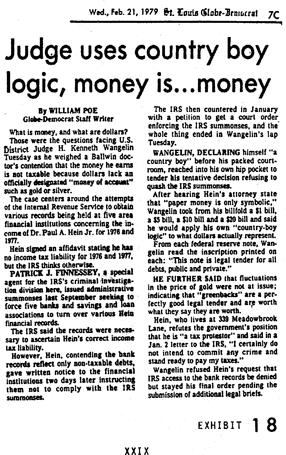

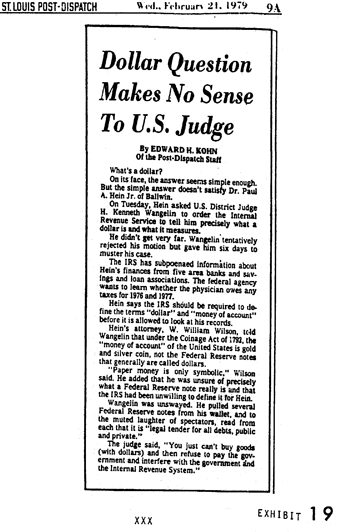

- Exhibit 18 & 19. The Courts will not help!

That the courts will not help is very significant to the writing of this book. The Federal Courts take the view that the MONEY HOAX

is political in nature, therefore, not a matter for the courts. I have been told to take the MONEY HOAX

up with Congress. I wanted you, the reader, to see the futility of acting on that advice. No one will do FOR us what WE THE PEOPLE must do for ourselves. I promised the last Federal Court Judge, that told me to take it up with Congress, again, that I would take it to the court of Public opinion. I chose the route of associating the MONEY HOAX

to the income tax issue because in thousands of years it has always been true that you cannot discuss taxes without discussing the means of payment.

I will state everything as simply as I can. I assure you that this is NOT MY issue; it is OUR issue. We are being expropriated out of all the results of our labors, our representative government, our unalienable rights guaranteed under constitutional law, and everything else; we the people are no longer free we are slaves.

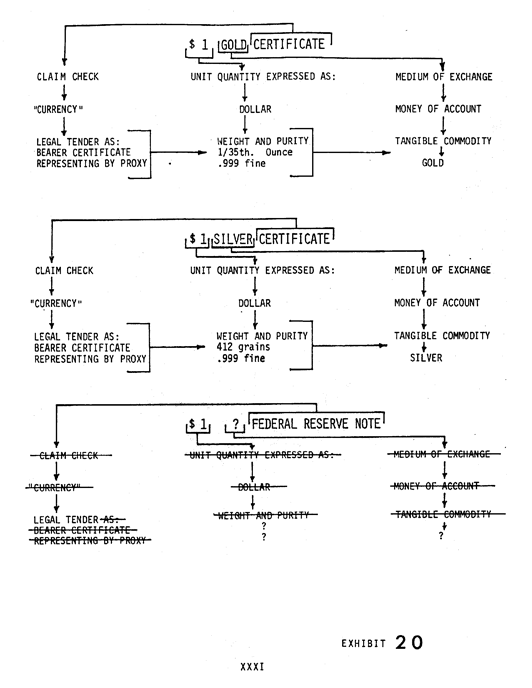

From the official documents it should be obvious that something that is extremely important for us TO KNOW is being KEPT from us. It concerns what, actually, is or is not money. It concerns what we think is or is not money. IT concerns the money and it is about time we concerned ourselves about what is or is not money. A study of exhibit 20 will make clear what the thing was, that we thought was money. It attempts to put into perspective gold certificates, silver certificates and Federal Reserve notes. It attempts to make clear why we thought these pieces of paper were the money and how the Federal Reserve notes were NOT the same as redeemable certificates, but being accepted alongside them as their equal for years, BEFORE having their specie redemptive powers removed, allowed them to replace the gold and silver certificates without notice.

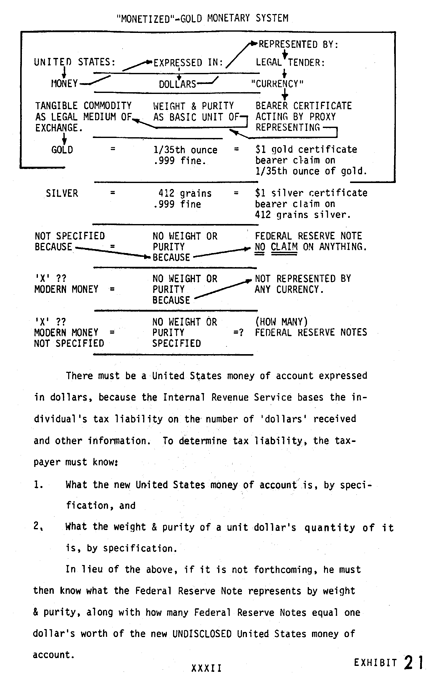

Exhibit 21 extends the perspective to include the modern, as yet, unspecified money of account. The imaginary, mysterious, everybody uses, but nobody knows what it is, medium of exchange.

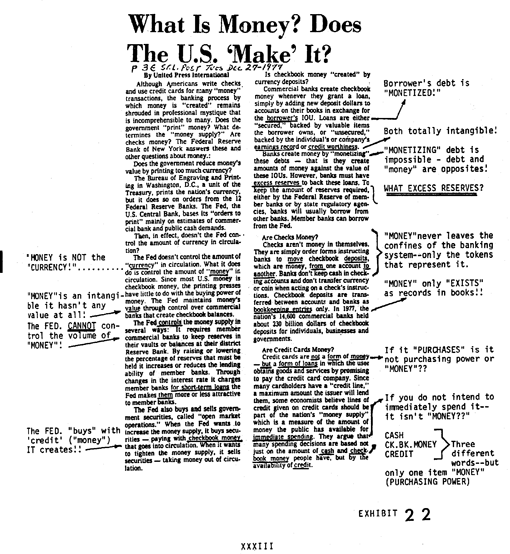

Exhibit 22 literally speaks for itself and also makes clear that the mystery is still there. LET’S CLEAR IT UP!

- Money:

- Was and still is anything WITHOUT parity accepted during an exchange.

- Barter:

- Was and still is anything WITH parity accepted during an exchange.

When gold and silver coin were called money it was an improper application of the termmoney;

they were barter used as media of exchange! - Medium of exchange:

- Anything accepted in exchanges for use in subsequent exchanges.

- Parity:

- The value of any one thing expressed in terms of another; equal worth or value.

If my simple definitions appear TOO simple; if it is your first thought that it could not be that simple and have gotten as messed up as the official documents indicate; then please read: Free Money, in which the validity of my definitions is confirmed.

This book is involved with how we are controlled, almost completely, and the ultimate destruction the means of that control will inflict upon the Earth and its population.

There is nothing sinister about a medium of exchange as long as it is barter. IT is when the nature of the medium of exchange changes to money per se that the users and holders of money become slaves to its creators and issuers and the beginning of the end commences to be a Treadmill to Oblivion.

Foreword

Perhaps the title of this book seems a bit unusual, but it should seem very familiar. Reduced to the simplest language using most familiar terminology it is exactly the philosophy of the space

age. Everybody is doing it — buying

now to pay

never. Just as we vote for one thing and get another, so it is with our spending

— we think we are paying

when in fact we are not! If you do not understand — that is the reason for this book.

DEBT — PUBLIC AND PRIVATE — IS HERE TO STAY … WHAT IS REQUIRED IS NOT THE ABOLITION OF DEBT, BUT ITS PRUDENT USE AND INTELLIGENT MANAGEMENT.

p. 33 Fed. Pub. Two Faces of Debt, Free on request: Chicago Fed. Res. Bank.

Buy now — pay never!

All the currencies

(paper tokens accepted as money

) of the world are floating

and the entire world is drowning in debt. All currencies

are fiat

but the public of the world does not seem to understand the significance of that. Currency

has always been the claim check

for the medium of exchange

it represented. Like a warehouse certificate the paper token unit had to be redeemable to maintain a stable parity relationship with goods and services.

It was not the paper token that maintained the stable parity, it was the commodity, that the paper token redeemed, that maintained the parity relationship. But since the paper token unit was the physical thing (issued against a given commodity held for its redemption) that changed hands it became accepted as being as good as the commodity that it redeemed.

Because the paper token (dollar bill

) was the physical thing handled and it remained the physical thing handled, after its specie redemptive powers were removed; the significance of specie-redemption-removal (issued without any commodity held for its redemption) went unrealized. The paper tokens (dollar bills

) themselves became accepted as the mediums of exchange

and the fact that they were FIAT

(non-redeemable) did not seem to hinder their use as mediums of exchange.

It seemed as though currency

did not have to be worth anything to function as a medium of exchange. THIS FALSE PREMISE TOOK ON THE CLOAK OF CREDIBILITY BY THE VERY NATURE OF THE REASONABLE AND LOGICAL SUPERSTRUCTURE THAT WAS BUILT UPON IT. CURRENCY

WAS ONLY A medium of exchange THAT EACH INDIVIDUAL HAD TO WORK FOR; TO OBTAIN IT FROM ANYONE ELSE, THEREFORE, ALL INDIVIDUALS EXPECTED EVERYONE ELSE TO WORK TO GET IT FROM THEM. A REASONABLE AND LOGICAL CONCLUSION.

Who realizes that the ENTITY that creates the money

pays ALL EXPENSES of that creation WITH part of the money

created and gets ALL ITS money

for nothing?

Who realizes that currency

worth nothing, being accepted by producers for their goods and services is a drain on production and a creator of accelerating cumulative debt that can never be paid?

How is it possible for a system like this to exist and continue to go on without anyone exposing it? How can bankers and accountants continue to use the system every day without seeing it for what it is? The illogical, unreasonable premise built to hide the true nature of MODERN MONEY

is as quoted above: CURRENCY

DOES NOT HAVE TO BE REDEEMABLE TO FUNCTION AS A MEDIUM OF EXCHANGE. Bookkeeping and accounting procedures require that there be assets as well as liabilities to make the system function. What asset can be represented by a non-redeemable currency?

The answer lies in the very nature of the currency

itself, being non-redeemable it causes debt, and debt in the form of OBLIGATIONS-TO-PAY by BORROWERS is the modern justification for the issuance of currency.

Debt which is a liability, when used as the COLLATERAL for the issuance of currency

becomes an asset as a borrower’s OBLIGATION-TO-PAY in bookkeeping and accounting. This twist by which debt (a liability) becomes money (an asset) in accounting carries with it some strange conclusions.

Modern currencies

of the world are issued on public and private debt collateral in the form of Government bonds, private notes and commercial paper. The amount of currency

issued is equal to the amount of debt offered by the borrower. The more debt incurred the more money received by the borrower therefore:

THE DEEPER IN DEBT ONE GOES THE RICHER THEY BECOME!

The above is a totally irrational conception that appears to be rational only if one accepts that there is no intention of anyone ever paying-off the debts.

Debt — public and private — is here to stay … What is required is not the abolition of debt, but its prudent use and intelligent management.

supra

In addition to securities, the federal government issues noninterest-bearing debt-currency or paper money. Currency is so widely accepted as a medium of exchange that most people do not think of it as debt.

Page 6 Two Faces of Debt, Free on Request: Chicago Federal Reserve Bank.

USING DEBT AS MONEY CREATES A THOROUGHLY CONFUSING DILEMMA CALLED MONETIZED DEBT.

Normal concept is that debt is a liability and money is an asset. When debt is money — liabilities are assets and bookkeeping no longer determines net worth, but simply records transfers of OBLIGATIONS-TO-PAY. Obligations-to-pay are not final payment therefore MONETIZED DEBT

results in a run-a-way accumulation of debt THAT CAN NEVER BE SETTLED!

A warehouse receipt for PEAS, COULD NOT redeem BANANAS. A warehouse receipt for BANANAS, COULD NOT redeem PEAS. In our former MONETARY

system, a GOLD CERTIFICATE COULD redeem SILVER, a SILVER CERTIFICATE COULD redeem GOLD and the Banker’s created CREDIT

COULD redeem GOLD or SILVER from deposit. This FRAUDULENT procedure was made possible by the symbol ($) representing the quantity specification DOLLAR

mistakenly accepted as an ENTITY, thereby removing all respective identity of things deposited.

Modern money, based on debt, referred to and measured in terms of dollars

and without redemptive powers on any commodity only serves to represent the RIGHT to TRANSFER OBLIGATIONS-TO-PAY. A transferred obligation-to-pay CANNOT be final payment therefore MONETIZED DEBT

NEGATES THE PAYMENT OF DEBTS and debt accumulation accelerates at an ever accelerating rate (runs away)!

The currency

(paper tokens) cannot be considered redeemable with the borrower’s collateral because the currency

issuers will not redeem the currency

by paying-out the collateral. The currency

(dollar bills

) are no better than BAD CHECKS for which there is nothing on deposit, yet they seem to function without anyone realizing the embezzlement they perform. There is a very understandable reason for that. A bad check is eventually FOUND OUT

when the endorsement space on the back is used up and it is deposited for collection. Bad currency

(dollar bills

), however, do not require endorsement, therefore they pass from hand to hand without their true nature ever being exposed, until debt accumulation, with its unpayable interest burden, brings about the inevitable, final collapse.

In this MODERN MONETARY SYSTEM where debt is referred to and measured in terms of dollars,

accepted as ENTITIES, there is a built-in perpetuating force called INTEREST.

In the course of issuing money

to a borrower, the issuer always charges a fee. The fee for borrowing money

is called interest. The interest is specified in terms of dollars

and must be repaid

by the borrower in addition to the principle amount. Only if we consider ALL BORROWERS as ONE can we understand that MORE CANNOT BE RETURNED TO AN ONLY SOURCE

than is TAKEN from it. All commercial banks, the creators of MODERN MONEY, are regulated by the Federal Reserve Board (the Monetary Authority) and are the only source of modern money.

Currency

borrowed by one borrower can be earned and used by another to pay

interest, but the currency

borrowed also bears an interest burden. In the public’s efforts to pay interest they are collectively borrowing more with which to pay

it. As the additional currency

is borrowed with which to pay interest, it becomes principle itself and draws interest. Interest burden never goes away. Interest is perpetual. INTEREST CANNOT BE PAID!

If all borrowers were to pay-back all the money borrowed, (ALL THE DOLLARS

they RECEIVED

), they would still owe all the interest and have no dollars

with which to pay it. The interest burden climbs until it is greater than the total production of all borrowers, then the system collapses. THE PEOPLE, IN FULL USE OF PERPETUAL DEBT AS MONEY, A BUY NOW — PAY NEVER SPREE, ARE TOTALLY UNAWARE OF ITS CONSEQUENCES, AND ON A TREADMILL TO FINANCIAL OBLIVION.

Why should you believe me when we the people have been led to believe that all the economic problems we experience emanate from a mysterious monster called INFLATION? A monster so complex and devious that our best NOBEL PRIZE winners and high officials cannot understand it?

Rising inflation and rising unemployment have been mutually reinforcing, rather than the separate effects of separate causes.

Mr. Milton Friedman — Nobel Prize Page 3 N.Y. Times 1-30-77

The rules of economics don’t seem to work like they are supposed to.

Mr. Arthur F. Burns, Chairman of the Federal Reserve Board Page 3 N.Y. Times 1-30-77

One reason why economists are in such disrepute is that they have pretended to understand inflation and to know how to control it, when obviously we do not.

Mr. Wassily Leontieff — Nobel Prize.

If I have done my thinking clearly and objectively there is only one thing that IS INFLATION and that is modern money

which is DEBT represented by paper tokens called dollar bills

which are accepted by the people as our currency.

Now if government prints the currency they should only print enough for the public to use to pay their taxes with. That is all they are entitled to. If they print more than they have coming in taxes that would be the same as counterfeiting would it not? The Government could not spend more than they print, but they could print and spend more than they have coming in taxes. That must be what they call deficit spending.

The public has to give-up some production or perform a service to get currency.

That is why the system works

because everyone has to work to get dollars

therefore they expect everyone else to work to get dollars;

except Government, which has the power to tax the public. If the government can print and spend more currency

than it has coming in taxes, why don’t they just print what they want and forget about taxing the public?

Government uses the currency

it takes in taxes to spend for the goods and services it needs to operate. Why don’t the public use THAT currency

it receives with which to pay its taxes? Why does Government have to print so much, all the time? Some is needed to replace old and worn paper tokens. Some is needed to accommodate expansion. But the prodigious amounts being printed cannot be for just those two reasons.

Why does the Government print so much currency?

What do they do with it when they are finished printing it? If they print it and have it why don’t they spend it into circulation or is that what is done? If they spend it into circulation and print such prodigious amounts of it, why does the Government have to borrow?

We know that the government prints it. We know that the people have to work to get it. But how do the banks get it to loan to the people and to government?

If the banks get it from the government why does the government have to pay interest to the banks when they borrow it back? Why do they have to borrow it back when they had it in the first place, why didn’t they just use it? If they just use it, that would be unfair if what they used exceeded what they had coming in taxes. However, they are printing prodigious amounts of it. What is being done with it? Who gets it and for what?

In the old days, before this modern money,

the printed currency

was all silver and gold certificates. There was silver or gold coin on deposit that could be redeemed with the certificates, and surrendering the certificate took it out of circulation.

Gold and silver coin had to be on deposit for redemption of the certificate outstanding. Government could not print more certificates than there was gold or silver coin on deposit to be redeemed. We knew exactly who got the certificates printed by the government. Whoever deposited gold and/or silver coin got gold and/or silver certificates as receipts of the deposit. Who deposits what; to get the modern money?

Government printed a modest amount of currency

to replace old worn out paper tokens and some additional to cover new deposits of gold and/or silver coin but never the prodigious amounts as now. What is increasing at such prodigious rates that it can justify this accelerating acceleration of the currency

volume. It is not gold and it is not silver coin — what is it?

Government printing such huge volumes of currency,

far exceeding any claim on taxes, must be printing it to represent something. The currency

being printed does not have anything ON DEPOSIT to represent. The currency

cannot ever be removed from circulation in the old way by redeeming a deposit because there isn’t any deposit. It must represent something that is growing at the same prodigious rate as the money

volume. Something that cannot be deposited and yet establishes a link between the printing of currency

and who should get it.

When I finally discovered the truth, it boggled my mind. No wonder our trained and learned Nobel-Prize winning economists could not discover it. Their minds could never conceive that a condition like this could develop. The answer is accurate but thoroughly unbelievable.

The only thing growing at the same prodigious rate at which currency

is being printed is DEBT. The currency

is being printed to represent DEBT. When a borrower accepts the liability of a loan he receives money.

The deeper in debt he goes the more money

he receives. The currency

(paper tokens) looks the same as the old gold and/or silver certificates that were issued when gold and/or silver coin was deposited. The new Federal Reserve notes

are paper and are issued, not upon deposits being made (coins coming into the bank), BUT upon loans being taken out! Currency

for which there is nothing on deposit cannot represent anything but DEBT ITSELF, therefore anyone accepting a liability is entitled to the currency

representing their debt. The amount of currency

received is commensurate with the volume of their loan

No self-respecting economist could possibly accept a concept that boils-down

to: THE DEEPER IN DEBT YOU GO THE RICHER YOU BECOME. It is too fantastic and unbelievable. But the evidence of its BEING is irrefutable. The debt volume and money

volume are both growing at prodigious and respective amounts. The very fact that currency

can be spent, and the currency

is given to those going into debt gives the system its name. The Modern Money

system is called the MONETIZATION OF DEBT.

Making DEBT SPENDABLE

is quite an invention and it is in full operation, though how to justify it, DEFIES ME. There is proof that some recognition of this condition does exist.

Expansion of Central Bank holdings of Government debt provides the Treasury with funds just as certainly as increased output of its engraving and printing facilities.

Page 17 Federal Reserve Bank of St. Louis Review February 1975

Debt is spendable, but the paper tokens issued to represent it and make it spendable, are not collectable

from the issuer. The issuers of the paper tokens are not producers of goods. The issuers can never be called upon to give up anything for currency The debt represented by the

The issuers of currency

is used by the issuer to obtain production without any fear of ever having to pay

for it; BUY NOW! — PAY NEVERcurrency

get everything IT buys

for nothing. The producers never get wise to their loss because they never suspect the truth. The PRODUCERS all exchange the currency

with ONE ANOTHER, giving and receiving in turn, using the currency

as a medium of exchange. It never occurs to the producers that the ISSUERS get the currency for nothing and will not give anything for it.

How could any self-respecting economist admit to being a part of a system like that if he truly understood it? There is a possible touch of remorse in the words of Darryl R. Francis then President of the Federal Reserve Bank of St. Louis before the Committee on Banking & Currency, House of Representatives, July 18, 1974:

I doubt that monetization of debt has been a conscious act on the part of the Government or on the part of the Federal Reserve System. Rather, I believe the reason it has occurred lies in the relative visibility of the three methods of financing Government expenditures — taxes, borrowing from the public, and indirect debt monetization … in the case of debt monetization, the immediate and even the short-run impact is neither an increase in taxes, nor an increase in interest rates. And yet, real resources still are being transferred from private to Government use.

The above quote points out that through DEBT MONETIZATION it is possible to STEAL without being found out. Stealing is what debt monetization really is when it is analyzed from any objective viewpoint. How can an economist, trained in these matters, be around it so long without seeing a truth so obvious?

With currency

being printed in such prodigious quantities, how come they do not ask themselves who is getting it? For what? Why? Thousands of economists World Wide and no one can see this as STEALING! I am amazed and full of wonderment at a profession that flounders around trying to out guess one another as to what is wrong. Why rules of economics do not seem to work like they are supposed to. It only took a few pages here to reason out that no amount of debt can eliminate debt. Any multi-year excursion into the realm of fantasy and nonsense must end in disaster.

There are only two conclusions I can come to: Either the entire economist membership is totally incompetent, or they are united in their efforts to prevent the panic that will surely come when the public finds out. In the words of Jacques Rueff 1961:

It is the product of a prodigious collective error which will remain in history and, will eventually be recognized as an object of astonishment and scandal:

All I could add to that is that the United States and the world is running wild on this BUY NOW! — PAY NEVER! Spree, and it is for certain a Treadmill to Oblivion!

Our earth is degenerate in these latter days; bribery and corruption are common; children no longer obey their parents; every man wants to write a book, and the end of the world is evidently approaching.

From an ancient Assyrian tablet

How no one can correct a fault of which he is unaware

The world is Governed by very different personages from what is imagined by those who are not behind the scenes.

Benjamin Disraeli

Any one who has seen a Magician

perform cannot deny the powerful effect of his illusion. He is billed as a Magician

and we expect the illusion and so it is entertainment. To say that truth is stranger than fiction is much easier than getting anyone to accept that premise. Yet, truth IS stranger than fiction. In the above quote Benjamin Disraeli brings out how important viewpoint

is, by his reference to behind the scenes.

From a vantage point behind the Magician

some of his magic

may become exposed. Viewpoint is the deciding factor in observing many false premises accepted as truth by the public, as a whole. Some acknowledgment of this is accepted as can be proven by a well known saying: You cannot judge a book by its cover.

Well known and accepted as it may be, investigation indicates that more books are sold by title

than by content.

There seems to be no limit to which humans will not stretch their imagination to accept a false premise. I was once told, in no uncertain terms: The truth will not sell.

There is a great amount of evidence to support that statement and yet I feel that if the truth will not sell, nothing else is worth selling. Truth is fact, correctness, actuality, reality, etc., not as something appears to be, but, what it actually is. To arrive at truth about anything requires observation, calculation and deduction. Only theory is debatable, truth is final. The volume of what is accepted as truth, but is not, is far beyond any human’s normal ability to accept. If this were not so, then truth would not be stranger than fiction.

The entire world as the general public knows it, is not as it appears to be. What the public believes is true is really false and what is really true they are not aware of and will not accept when informed of it — The truth will not sell.

Shakespeare’s As You Like It

contains the line: All the world is a stage etc.,

that is true. All

the people are performing unaware that they are performing, in accordance with directions from a director, stage-manager, and a scenario they are completely unaware of. The words of Benjamin Disraeli again The world is governed by very different personages from what is imagined …

repeat the world is governed.

No mention here of nations, countries, or municipalities, repeat: the WORLD is GOVERNED.

Was he wrong or is there a force on Earth that directs the behavior of its occupants. That directs them to believe in nations, and nationalities, wars of aggression and greed when in fact none of that is really true. It happens and we see it happen and it is played out upon the stage for us to participate. People are killed, wounded and missing-in-action, that is real only as long as we do not look into the wings or into the audience. This scenario is acted out on a stage that is the Earth itself. There is no wings or audience as such.

THE STAGE AND THE THEATER IS ONE, THE PERFORMERS AND THE AUDIENCE ARE ONE, AND THOSE FEW WHO ARE THE INVISIBLE GOVERNMENT ARE WHOLLY HIDDEN AMONGST US.

HOW DO WE PROVE THE EXISTENCE OF THIS UNKNOWN SCENARIO, THIS UNSEEN DIRECTOR AND STAGE MANAGER?

- Who is this invisible government?

- What is its force?

- Where does it get its power?

- When will it end, if ever?

- Why does it persist over the truth?

| WHO | The invisible government of the world is its world wide interdependent banking system. |

| WHAT | Its force is the moniesof the world it creates. |

| WHERE | It gets its power from the fact that all moniestoday are monetized debt. The people’s credit, monetized by the bankers and used to control the people. |

| WHEN | It will end when its exposure will be accepted by the people and they refuse to use monetized debt as a medium of exchange. |

| WHY | It persists over the truth because all the power of modern moneyis used to subvert the truth and support a belief in the false world the people SEEall around themselves. |

How can this small group of people, hidden within the main body, direct the policies of the body as a whole, without detection? It is possible because most people accept what they see and what they hear without applying any tests for truth. When only gold and silver coins were used and called money, it was believable that one nation might attack another to get needed material it could not pay

for. But with modern money,

created by the billions, and used to purchase with, why fight, for something you can get with modern money,

which costs you nothing?

The people will believe that one country attacks another for chrome, or nickel, or copper, never realizing that with modern money

it can be bought

for nothing. Who could you not corrupt, if money were no object? What could you not buy,

if money were no object? Where could you not go, when could you not use it? Why would you not use modern money

if you were the one licensed

by the world to create it? You do not have to go beyond the pages of the Wall Street Journal to find this truth.

In Kingston, Jamaica, this week, 20 representatives of the 128 members of the International Monetary Fund will be playing a marvelous game. The IMF Interim Committee — 10 delegates from the industrial nations, 10 from the developing countries — will create about $14 billion in fresh money, after they haggle over who gets to spend it, under what conditions.

The international bureaucrats assembled in the sunny spa don’t normally admit that what they are doing is simply printing money; they describe the process as an expansion of IMF quotas. Nor is a printing press used. The IMF members — including the United States — merely agree that the IMF should write in its ledger that it has an extra $14 billion to lend to the poor and deserving.

Now this inflation-groggy world certainly does not need the injection of another $14 billion in base money, likely to be multiplied into a far larger addition to the world’s money supply.

Review and Outlook Wall Street Journal Page 12 Wednesday, January 7, 1976

WHO CREATED $14 BILLION?

20 representatives of the 128 members of the International Monetary Fund.

WHO GETS TO SPEND IT?

… after they haggle over who gets to spend it,…

WHAT WAS THE $14 BILLION?

… fresh money …

WHERE WAS THE $14 BILLION CREATED?

In Kingston, Jamaica …

HOW WAS THE $14 BILLION CREATED?

… merely agree that the IMF should write in its ledger that it has an extra $14 billion …

WHEN WAS THE $14 BILLION CREATED?

… this week …

WHY WAS THE $14 BILLION CREATED?

… to lend to the poor and deserving.

DID WE REALLY NEED ANOTHER $14 BILLION?

Now this inflation-groggy world certainly does not need the injection of another $14 billion in base money, likely to be multiplied into a far larger addition to the world’s money supply.

AGAIN: How was the $14 Billion in New Money created?

BY TWENTY REPRESENTATIVES OF 128 MEMBERS OF THE I.M.F. MAKING-BELIEVE THEY HAVE IT BY — MERELY AGREEING THAT THE I.M.F. SHOULD WRITE IN ITS LEDGER THAT IT HAD IT …

AGAIN: Who did the haggling over who gets to spend it?

TWENTY REPRESENTATIVES

Money power denounces, as public enemies, all who question its methods or throw light upon its crimes.

William Jennings Bryan 1896

We have awakened forces that nobody is at all familiar with.

John Connally — Newsweek 8-14-71

What’s at stake is nothing less than the economic order of the free world.

Austria’s then Central Bank Chief Wolfgang Schmitz 9-11-72

HOW CAN ANYONE BELIEVE IN A GROUP OF ‘IN’-DEPENDENT NATIONALISTIC NATIONS — WHEN THEY ARE ALL ‘INTER’-DEPENDENT THROUGH THE INTERNATIONAL MONETARY FUND?

Those who create and issue money and credit direct the policies of government, and hold in the hollow of their hands the destiny of the people.

Rt. Hon. Reginald McKenna former president of the Midland Bank of England, ex-secretary of the British Exchequer 1920

Twenty representatives of 128 nations create money, which is all powerful on government policies and destinies of the peoples of those governments. Representatives of 128 nations joined in one organization, to create a belief in monetized debt, to fool and exploit all the people of the world. No one nation could act independently without breaking the conspiratorial agreements that keep the world’s people fooled.

… what is a dollar its just something artificial we throw out there … what you’re doing is you’re fooling people …

Denis Karnofsky — Chief economic adviser St. Louis Federal Reserve Bank — onNEWSMAKERSCh. 4 TV June 10, 1978

Make-believe money

can only be used when it is created in one human mind and accepted in ALL others. If any group of people or nations stopped believing in the monetized debt-make-believe money,

its power to support belief in a false world, would be replaced by truth, proportionately. The whole world is in the grip of this monetized debt, MODERN MONEY MADNESS

and are believing that the world, as they SEE

it is the real world.

How modern ‘money’ is control over people

- If anyone points a gun in you direction — you fear!

- If anyone flourishes a knife in a threatening manner — you fear!

- If anyone raises a club as if to strike you — you fear!

An individual does not have to have been shot to fear a gun. No one has had to have their throat cut to fear a knife. It is not necessary to have been clubbed before, to fear the hurt a club can inflict. What then makes you fear anything, if we have not had personal experience with its potential for creating agony? It is the enlightenment we have had through the various media of information that tell us people can use guns to inflict injury and death.

From the time we were children we have been taught that knives are sharp and used improperly can inflict injury. All of us at one time or another have been cut and this lesson makes knives a most effective weapon to threaten anyone with.

In the case of the club or any heavy object raised in a threatening manner, the fear generated is from self-deduced obvious conclusions of what it would feel like to have that object come in contact with our body.

BUT! WHY DON’T WE FEAR MODERN MONEY?

Modern money

(inflation) wrecked Germany in 1923. The people when questioned readily agreed they would accept another WORLD WAR I before they would go through another monetary collapse.

Our own historical experience with Continental Dollars

caused the Constitution to specify only gold and silver coin as the money of account of the United States.

Only through the reintroduction of gold coin into France, was Napoleon able to bring order out of chaos, after the French monetary collapse.

Throughout its entire existence, the NAZI REGIME outlawed the use of gold as a medium of exchange in Germany. The results of the NAZI’S use of modern money will live in history for ages as the most heinous. What war cannot be started, continued, and the outcome decided by the nation with the most modern money? What war could be continued after the modern money ran out? If it is not modern money — what then is the ultimate weapon for all time?

Modern

Jenkins Law 11 1971money(inflation) accepted as a medium of exchange subjects people and their government to the influence of its creator.

OLD

MONEY

(gold and silver coin).

MODERN

MONEY

(monetized debt).

I can find no benefits accruing to the whole of society from debt monetization, but the risks are very serious and can be expressed in one word — INFLATION.

Darryl R. Francis, then President of the Federal Reserve Bank of St. Louis.

THINK

PLACE YOURSELF IN THE POSITION OF BEING ABLE TO CREATE MONEY; EVERYONE MUST ACCEPT IT (YOUR LEGAL TENDER ACT); NO ONE REALLY UNDERSTANDS WHAT

YOU HAVE GOING

FOR YOU (ITS YOUR SECRET); ALL THE MONEY

IN THE WORLD IS YOURS TO CREATE (MONEY

IS OF NO OBJECT TO YOU); UNDER THOSE CONDITIONS:

- What function of Government could not be corrupted, by you?

- What business could not be destroyed, by you?

- What manner of injustice could not be inflicted on anyone, by you?

- What truth could not be suppressed, by you?

- What commodity could not have its price suppressed, by you?

- What commodity could not have its price supported, by you?

- What commodity could not have its supply decreased, by you?

- What commodity could not have its supply increased, by you?

- What information media policy could not be directed, by you?

- What educational material could not be distorted, by you?

- What school could not have its policies directed, by you?

- What crime could not be

gotten-away-with,

by you?

THERE IS NO AMOUNT OF CORRUPTION YOU COULD NOT GET-AWAY WITH

IF YOU HAD ENOUGH MONEY!

Government, Business, Justice, Truth, Prices, Supply, Information, Education, Schools and Crime are all subject to corrupting influences by anyone to whom MONEY

IS NO OBJECT!

Government is controlled by Modern money,

therefore Government does not create Modern money,

or it would control itself. There is only one entity to whom Modern money

is no object. It is the commercial banking system (under regulation by the Federal Reserve Board) that has an OPEN ENDED

checking account.

These are the men who create the money we all spend … in effect they determine whether you will be able to buy a car, can afford to take a vacation or buy a new home. Their decisions can effect the security of your job … in the deepest secrecy they plot their strategy … everything is cloaked in deepest secrecy … in making decisions they check with no one — not the President, not the Congress, not the people.

Page 14 PARADE MAGAZINE October 26, 1975

The Commercial Banking system through its monetized debt

(Modern Money

represented by non-redeemable paper tokens) is the SUPREME force WHO’S WILL IS LAW in the United States.

WHOEVER WOULD RETURN GOVERNMENT TO THE WILL OF THE PEOPLE

MUST FIRST RETURN THE UNITED STATES TO THE USE OF CONSTITUTIONAL COINAGE AS A MEDIUM OF EXCHANGE AND THROUGH IT THE CONSTITUTION AS LAW IN THE UNITED STATES.

How compound ‘creation’ increases embezzlement potential

DEMAND LIABILITIES of Commercial Banks are money.

DEMAND LIABILITIES are DEPOSIT CREDITS, a MAKE-BELIEVE medium of exchange CREATED by the bank upon receipt of commercial paper or personal notes from the borrowers. The deposit credits become units of IMAGINARY medium of exchange created out of nothing and consisting of nothing, but their make-believe presence as RECORDED on the books. They are represented by physical tokens issued by the bank in exchange for the borrower’s claim to those MYTHICAL units of IMAGINARY medium of exchange. By the use of checks (written directions to banks to shift claims on units

from one account to another) and paper note

tokens and alloy metal coin

tokens, the presence

of the not present

is accepted and used daily in the economy.

The units

of make-believe medium of exchange are actually what is called banker’s credit;

the RATIONAL FOR banker’s credit

is that there EXISTS an unwritten

acceptance of the fact

that since the banker is a respectable business man with a large investment in buildings, vaults, and equipment, that his credit

in the neighborhood is preeminent. Where a member of the non-bank public may default on a note, the banker’s business depends on his reliability and integrity. A member of the non-bank public (borrower) gives the banker a pledge to pay-back

and the banker gives the borrower the right to use his banker’s credit

as THEIR OWN, up to the limit of the loan

amount.

The banker has a very unique SPECIAL LICENSE:

he is allowed to use his credit INDIRECTLY, through borrowers, WITHOUT GIVING A PLEDGE OF PAY-BACK

TO THE MERCHANTS. The banker lends the purchasing power

he DOES NOT HAVE DIRECTLY to borrowers to use in the economy. The system is so subtle its fundamental premise (THE RIGHT OF ANY GROUP TO CREATE DEMANDS, WITHOUT COMPENSATION, UPON THE PRODUCTION OF OTHERS) is never questioned. All the checks that are deposited by merchants are deposited into the banking system, which is so secret about its records that no outsider

has ever audited the Federal Reserve. The deposit credits are the bankers entering in the borrower’s account the numerical notation to ACCEPT AS GOOD ALL CHECKS written by the borrower up to the NUMERICAL LIMIT of the LOAN.

The purchasing power

represented by this numerical notation, to accept as GOOD

checks written to that amount, is the NUMBERS IN A BOOK

that IS the recording of the mythical, psychological, entity (demand liabilities of commercial banks) called MONEY

by the public.

There isn’t any gold in the vaults, there isn’t any silver, in the vaults, there are no shoes, eggs, quarts of milk, cars, buses, airplanes, toys, candy, jewelry, diamonds, clothing, medicines, art supplies, or any produced goods, for which these numbers can be redeemed. The bank will issue copper-nickel alloy coin

tokens and paper note

tokens to represent these numbers in the economy, to give credibility to the mythical, psychological, entity; but because there is no production or ANY tangible thing on deposit for their redemption they are not redeemable by the issuer (the commercial banking system) for gold or silver coin as SPECIFIED in the United States Constitution.

The banker’s credit

or deposit credit

or demand liability

or whatever terminology is applied to this IMAGINARY purchasing

unit does not really matter. What is imperative to know and understand is that this unit

of NOTHING that is being USED by everyone is the ONE AND ONLY MONEY

IN USE TODAY. The modern

money

which in times past was known as banker’s credit

was recognized, for many years, as being a competitor and expropriator of the, so-called real money

(gold and silver coin). Today with gold and silver coin no longer in use, the only legal tender we have, WE DON’T HAVE, because it is only an object of thought (totally mythical and psychological in nature).

Money is such a routine part of everyday living that its existence and acceptance are ordinarily taken for granted. A user may sense that money must come into being either automatically as a result of economic activity or as an outgrowth of some government operation. But just how this happens all too often remains a mystery … the actual process of money creation takes place in commercial banks. As noted earlier, demand liabilities of commercial banks are money.

MODERN MONEY MECHANICS Page 2-3 Published by Chicago Federal Reserve Bank — Free on request

… the PROCESS of money creation …

Its a MENTAL process! BUT!

The original creation of deposit credits (demand liabilities of commercial banks) which are records of a make believe medium of exchange

loans

on the basis of commercial paper or personal note collateral is ONLY THE BEGINNING!

Creating an IMAGINARY medium of exchange is fantastic enough (the actual thing

used is an object

of thought), but the procreation (regeneration) or expansion of the volume, PROCESS

is considerably MORE fantastic.

The RATE of INCREASE in total volume of deposit credits that are procreated (generated) is regulated

by the rules of the system. The RATE of total volume increase is the result of basing an allowable increase amount on a multiple

of the AMOUNT of original deposit credit (demand liability) claims REDEPOSITED in the bank by the claim holders. The entire system depends on CONFIDENCE

in it, and acceptance by the non-bank public that as long as you can keep on borrowing

there is never any NEED to STOP EXPANDING, but only a need to REGULATE

the GROWTH RATE of the total

money

volume.

Debt — public and private — is here to stay … What is required is not the abolition of debt, but its prudent use and intelligent management.

Page 33 Two Faces of Debt, Publication of Chicago Federal Reserve Bank — Free on request

If the RATE is TOO GREAT the fallacy

of believing you can borrow yourself out of debt becomes exposed, because the purchasing

power per unit

deteriorates too rapidly (prices rising). By tempering the system the fallacy

remains obscured, prices rise slowly and people accept the changes as PROPERTY APPRECIATION.

The system makes use of a take-off on an extremely successful scientific control device: the feed-back loop.

By monitoring the amount of output that returns

to the system as input, the output is made proportional to the input. The system is tempered not to create imaginary purchasing power TOO RAPIDLY by linking it to how much of that

ALREADY CREATED is NOT BEING USED and is REDEPOSITED as SAVINGS.

Money

not being used in the economy, has no effect on prices,

(Jenkins Law of Competitive Bidding as opposed to the Law of Supply and Demand).

Maintaining a PROCREATION-to-SAVINGS ratio fairly constant (if that were possible) would make the ultimate effect of constantly accumulating debt APPEAR SO GRADUALLY that its appearance

at all would be, for all practical purposes, not possible or more readily accepted as being natural

appreciation of property.

Deposit credits (demand liabilities) are originally created by the bank for a borrower. There is no other way, there is either a borrower or there is no original creation. The bank creates and the borrower takes possession

by receiving a written deposit receipt

that he owns the units

of imaginary medium of exchange. He can hold

units

or exchange units

in the economy, passing his claim

on to another by means of physical tokens (checks, paper notes,

or alloy coin

tokens) that represent units

of imaginary medium of exchange. The holder of a claim

on units

no matter how received, or in what form

they

might be, may dispose of units

in exchange, hold units,

or he may DEPOSIT

units.

A deposit

of units

is handled just as though it were a deposit of something physical. Nothing really entered the bank except tokens, but the records are altered to show the NEW STATUS of the claim. A deposit

— (returns a claim on units

to the status of a demand liability of the bank), for the claim holder, in a SPECIFIC account. It may be the claim holder moving funds from his savings account to his checking account, or from his checking account to his savings account, or it may be a merchant depositing a claim received in exchange. If it is a checking account then the claim on units

can only be shifted by the owner

issuing a check (transfer instructions) to the person from whom he received something in exchange. If it is a savings account then the claim can only be altered through withdrawal,

by surrendering a portion or all of the claim on units

noted in a pass-book

in exchange for paper or metal tokens or deposit credit in a checking account. If the claim on demand liabilities is in a specific

account, checking or savings, then the deposit

is considered to be part of the bank’s RESERVES, which means that UNTIL instructions come in to alter the record of claim, the bank itself, can use those units

for ITS reserve requirement DEPOSIT

at the Federal Reserve. The AMOUNT of units

REDEPOSITED

in various types of REDEPOSIT

accounts is the result of the actions of the non-bank public. To neutralize any negative effect, an increase or decrease in RATE of redeposits

might have on their plans, the Monetary Authority SETS the MULTIPLE

that must be applied in THEIR subsequent procreation (expansion of the accumulated volume by new creation for new loans).

A 100 unit

claim

redeposited

in a checking

account will justify a specific

increase in the total volume of units.

The rules specify that the bank MUST hold a portion of that 100 unit

claim as its own reserves,

when it lends the difference out to another borrower. If the reserve requirement

is 8% then the bank will hold 8 units,

out of the 100, as its reserve

and lend out the remaining 92 units.

With 8 held and 92 issued it establishes a Multiple

of 11.5 for expansion. The banking system at that reserve requirement

would be maintaining a PROCREATION to SAVINGS ratio of 11.5 to 1 (92÷8 = 11.5). The amount of procreation is then 11.5 times the redeposit

AMOUNT of THOSE ORIGINALLY CREATED. Units

of IMAGINARY mediums of exchange (nothing) is giving BIRTH

to additional units

of IMAGINARY mediums of exchange (nothing) with the birth of 11.5 units

from 1 unit. Nothing

is procreating (generating) more nothing

to swell the accumulated volume, in ever accelerating amounts, as this TOTALLY UNBELIEVABLE — PROCESS — continues.

The claim holder

who redeposits

100 units in a checking account, obviously, does it with the intention of eventually writing checks against that claim. The bank loaned out 92 of those same 100 units to a borrower, — and kept 8 for itself — in its reserve account. There is now DOUBLE the amount of purchasing power

that there was BEFORE the redeposit.

100 units

the redepositor can write checks against, 92 the new borrower can use and 8 in the bank’s reserve account. A total of 200 units where before there was only 100, hardly a MULTIPLICATION BY 11.5, BUT as mentioned earlier; THIS IS ONLY THE BEGINNING!

Remember the borrower who borrowed the 92 units put those in his checking account so that he could write checks against them. The bank took 7.36 units (8%) of that 92 unit redeposit

and put it in its reserve account, as per the rules and loaned out the difference of 84.64 units to a 2nd borrower. The total now looks like the following:

| Original claim redepositor | 100.00 | units |

| Bank’s reserve on 1st loan | 8.00 | units |

| Units loaned to 1st borrower | 92.00 | units |

| Bank’s reserve on 2nd Loan | 7.36 | units |

| Units loaned to 2nd borrower | 84.64 | units |

Total units now existing |

292.00 | units |

The system using an 8% reserve requirement which allows an 11.5 multiple of new creation (procreation) to savings

(those created originally redeposited

) will create 1,150.0 new units

of imaginary mediums of exchange for every 100 redeposited

as savings

and the effect of this amount added to the existing volume produces a RATE of increase that is NOT considered TOO RAPID!

A 3% reserve requirement allows a multiple of 32.33 or a procreation (generation) to savings

ratio of 32.33 to 1 which advances as follows:

| Original claim depositor | 100.00 | units |

| Bank reserve on 1st loan | 3.00 | units |

| Procreated for 1st new borrower | 97.00 | units |

| Bank reserve on 2nd loan | 2.91 | units |

| Procreated for 2nd new borrower | 94.09 | units |

| Bank reserve on 3rd new borrower | 2.82 | units |

| Procreated for 3rd new borrower | 91.27 | units |

| Bank reserve on 4th new borrower | 2.74 | units |

| Procreated for 4th new borrower | 88.53 | units |

Total units now existing |

482.36 | units |

On and on until the 100 units originally created through the magic

of redeposit

in a banking system account will justify by the fractional reserve system the generation of 3,233.33 units

of newly created (procreated) IMAGINARY purchasing power

to the volume already accumulated. Observing the ultimate LARGE effect in the accumulated volume that a SMALL change in the reserve requirement causes, it is evident that a change in the reserve requirement, whenever is directed by the Fed. is a significant move. Whenever the reserve requirement is lowered

(say to 5% from 8%) the banking system has MASSIVE MONEY

CREATING (LOAN) JUSTIFICATION AND the Fed.

is said to have LOOSENED THE PURSE STRINGS.

Whenever the reserve requirement is raised

(say to 8% from 5%) the banking system has SEVERELY CURTAILED PROCREATION JUSTIFICATION and the Fed.

who sets

the reserve requirement rate is said to have tightened the purse strings.

The license to set the reserve requirement amount percentage, lobbied for and obtained by the banking system, from Congress is one of the Monetary Authority’s coarse adjustment tools which it uses regularly to attempt to regulate the GROWTH RATE of the total money

volume.

IT IS IMPERATIVE TO OBSERVE THAT THE VOLUME WILL CONTINUE TO MULTIPLY ITSELF

AS LONG AS THERE IS ANY RESERVE REQUIREMENT UNDER 100%.

As UNBELIEVABLE as the original creation of imaginary mediums of exchange is to begin with, it is only by the procreation (self-generating) aspect of the system that we can understand that the seeds of its own destruction are sewn within it!

In the beginning even though the geometrical progression on the accumulated volume is great, its base is small and its effect on Prices

is minimal because of the time lag for its invasion to be felt in the far reaches of the economy (trickle down to the last man). In the beginning the rapid expansion appears as a boon and savings

are HIGH minimizing the amount that actually bids for goods. With an imaginary medium of exchange that multiplies itself — at 8% — in twelve cycles.

| 1. | 1 unit of original creation expanded | = | 11. 5 |

| 2. | 11.5 units of procreation expanded | = | 132.25 |

| 3. | 132.25 units of procreation expanded | = | 1,520.00 |

| 4. | 1,520.87 units of procreation expanded | = | 17,490.06 |

| 5. | 17,490.06 units of procreation expanded | = | 201,135.71 |

| 6. | 201,135.71 units of procreation expanded | = | 2,313,060.00 |

| 7. | 2,313,060.00 units of procreation expanded | = | 26,600,198.00 |

| 8. | 26,600,198.00 units of procreation expanded | = | 305,902,286.00 |

| 9. | 305,902,286.00 units of procreation expanded | = | 3,517,876,289.00 |

| 10. | 3,517,876,289.00 units of procreation expanded | = | 40,455,577,323.00 |

| 11. | 40,455,577,323.00 units of procreation expanded | = | 465,239,139,220.00 |

| 12. | 465,239,139,220.00 units of procreation expanded | = | 5,450,250,101,030.00 |

5 Trillion 450 Billion 250 Million 101 Thousand thirty.

How ‘confidence’ schemes increase the ‘power’

To be the Monetary Authority (money

creator and manager) is not enough in itself to guarantee complete control over the non-bank public. It is necessary to develop and introduce schemes that make certain that the non-bank public’s accepted authority (government

) in Washington is also under complete control. The term accepted authority

is used here to indicate the duly elected officials, who were elected to office by the votes of the people, in full accordance with the original U.S. Constitution and its first ten amendments, known as the Bill of Rights.

Once the Monetary Authority was brought into being, by Act of Congress, the banking system that LOBBIED to get the Act passed became the ACTUAL government. Congress as a victim of its own actions, has its policies directed by the creators of the money

who openly admit that laws are made for those who can pay for them. The Monetary Authority creates money

(the bidding

material) so they can out-bid the non-bank public at EVERY turn. The public may VOTE

for one of the choices they are given, but the official is ELECTED

by those that put up the money

for his campaign and buy him the vote

via the media (television, radio and newspapers).

The Constitution spelled out States rights

and made the state more powerful than the federation, it also made the people more powerful than the state. There were checks and balances that were supposed to preserve that arrangement. The Founding Fathers knew of the corruption of which bankers were capable and they made it very clear.

No state shall … make anything but gold and silver coin a tender in payment of debts …

Article 1 Section 10 Paragraph 1 Constitution of the United States.

If the American people ever allow private banks to control the issue of currency, first by inflation, then by deflation, the banks and corporations that will grow up around them will deprive the people of all property until their children will wake up homeless on the continent their fathers conquered.

Thomas Jefferson

Lobbying in Congress was successful and an amendment was passed circumventing those provisions in the Constitution. We now have FIAT (unfunded paper tokens as currency

) and every day that passes sees the Monetary Authority, through its front

the Federal Government, becoming increasingly more powerful over the will of the people. Through the Federal Government as its front

the real governing body (the Monetary Authority) is coming closer to being a true MONARCHY by virtue of a few simple schemes. One of the most difficult to explain is the initial scheme, the Monarch’s own version of the Pigeon Drop

(matching funds

) and its future mate, of a more diabolical nature, revenue sharing!

The individual members of the non-bank public are the only source of production and services, they labor to turn resources into useable-production. If there is INCENTIVE they will work harder and increase production. WITHOUT incentive they will work less and the production rate will decline. Anyone with enough ambition will eventually try to expand his enterprise by employing additional people, at a fair share of the profit from the increased capacity to produce, and in so doing increase his own total net return. The ability to profit from investing savings in business in a free enterprise atmosphere makes people successful, independent and proud. If these people are supporting their accepted authority (visible government) with taxes, they have a DEGREE of influence on its policies. The Monetary Authority does not want ANY interference with ITS policy directives. They develop ways to weaken their opposition

(the will of the people) by reducing the non-bank public’s independence and making them more dependent on the Monetary Authority. They introduce laws through THEIR front

(our government

) to tax the profits of free enterprise

and reduce the net income from which lobbying funds could come. Income tax was and is a violation of the original Constitution of the United States, and the Bill of Rights. The States were supposed to tax the people by-the-numbers

to collect the necessary support for itself and to pay their fair assessment for the support of the Federation. Income tax does its bit to keep down the opposition’s (people’s) power to influence

while it has absolutely no effect on the Monetary Authority, because the tax

is collected in the form

of money

and the Monetary Authority and commercial banks get all their money

for nothing.

In spite of the Income Tax,

private business managed to continue and in fact, by greater technological advancements, increase its production, trim its overhead and make a profit.

Next, Social Security was introduced to carry out a new way for the Monetary Authority to influence the opposition’s

take-home pay

and keep the non-bank public on the borderline of existence. Income Tax

was assessed on the basis of net profit. Social Security was a tax

that could be taken without regard as to whether or not there was a profit.

Along with the necessity to withhold income tax and social security tax

from the employee, the employer was required to MATCH THE FUNDS deducted from the employee’s pay for social security. The employee was receiving a fair share of the profits of the business in the form of wages, NOW BY LAW, the Fed.

could INCREASE the share of income of the business that would be TAKEN from the business before it could be given to the employee as an increase in take-home pay. And it could do all this without any regard as to whether it was fair or not. The true nature of this diabolical thing is exposed when it is observed that under the law, if an employee has too much taken out of his pay in a year (because of two or more jobs) he can get a refund, but the employer cannot get a refund of his matching funds

! Once a requirement like this is established by an Authority, the victim is at the mercy of the Authority, for AS LONG AS money

is accepted in exchange by the non-bank public, and the system is continued. No matter HOW MUCH money

that business may be able to send to lobby for a change in the law; the Monetary Authority can out-bid them. You would have GREATER success fighting the ELECTRIC utility with an ELECTRIC machine gun (you could throw it at them)!

When it is necessary for the Monetary Authority to bring a prosperous city or state to heel,

they employ methods that have proven themselves over a period of time and in various circumstances. A prosperous city or state paying all its debts on time and actually improving its public facilities is approached by a Federal agency with a proposition: you put up 50% of the cost of a new highway and the government

will, MATCH THE FUNDS with Fed.

money.

The City or State is influenced to increase spending beyond its means to GET the matching funds.

The City or State may or may not see their tax revenue being used up too rapidly and decide to pass-up a few propositions. The advertising campaign is then begun, through T.V. Radio and Newspapers and the non-bank public is subjected to all kinds of rhetoric on pollution, crime, criminal rehabilitation, etc., etc. until pressure is brought for the city or state to accept the government’s

kind offer. So the city or state finds itself employing more Police, more Pollution Control Inspectors, more employees at the prisons etc.; etc.; with the increased cost of maintaining all these expenditures the city or State begins to falter financially. Government

then comes to the rescue with another proposition; Revenue Sharing.

The government

agrees to refund to the city or state, some of the funds collected from its residents by the government.

Federal grants will be made by government

to the city or state to help pay the increased costs of the expanded Police dept., Educational expense, Pollution control, upkeep of streets and highways etc., etc. It should be understood that if St. Louis, Missouri gets a share of the taxes paid-in

by New Jersey residents so that St. Louis can have a new Symbolic Arch; that New Jersey is getting a portion of St. Louis resident’s taxes paid-in

to get the Mosquitoes out of their swamps, in reality, nothing is for nothing to the non-bank public!

Somehow it must be seen that the cities and states are being influenced to spend money

for projects that good financial management would never permit them to attempt. Expecting to get, SOMETHING FOR NOTHING, is the most powerful incentive to lead someone astray that was ever invented, it is like the Pigeon-Drop,

a con game scam. Matching Funds

& Revenue Sharing

are just such diabolical schemes; like the cruel trick of hanging a sausage from a stick tied to a dog’s back, so he will run himself to death; so are our cities and states rushing headlong into financial oblivion!

The purpose for all this is CONTROL.

The city or state through its Mayor or Governor respectively, attending a Mayor’s or Governor’s council in Washington, asks for handouts from government

(grants). GRANTS FROM THE MONETARY AUTHORITY THROUGH ITS FRONT

OUR GOVERNMENT

ARE THE MOST EXCELLENT MEANS OF IMPOSING POLICY DIRECTIVES!

If you collect the money — you disperse the people!

If you disperse the money — you collect the people!

Ancient Chinese Proverb

Translation:

He who pays the Piper calls the tune,

IN WASHINGTON TODAY:

When

moneytalks — everybody listens.Those with the most

money,control the most votes.

If the city or state does not CONFORM to the SUGGESTIONS

of the Monetary Authority presented through its front

the controlled

Congress, then the MATCHING FUNDS & REVENUE SHARING FUNDS are WITHHELD until the city or state DOES conform. The system guarantees that no matter how much independence the public tries to maintain through its elected officials, in reality, its elected officials ONLY LISTEN to the DIRECTIVES of the group that put up the money

for their election. The people only get the privilege of VOTING for candidates. Their CANDIDATE CHOICES

are DECIDED FOR THEM by those already in power. The perpetuation of the system AS IS, is ASSURED because the one ELECTED will be one of those PRESENTED for the VOTES. It doesn’t matter what party

affiliations a candidate may have, because in the end all elected officials are compelled, directly or indirectly, to respond to the directives of the Monetary Authority.

It does not matter what you CALL the system, it still allows CONTROL OF A NATION’S PUBLIC to be vested in one INDIVIDUAL; the one who directly controls the Monetary Authority. The Founding Fathers with their Constitution gave us a Limited Republic, the Fed.

made us believe it is a Democracy (majority rule) when in FACT we really have an OBSCURED MONARCHY

!

… the world is governed by very different personages from what is imagined by those who are not behind the scenes.

Benjamin Disraeli

How industry is forced to become dependent on the banks

Rolling over

debt is the inevitable means taken by mostly all industrial borrowers who eventually arrive at the point where they cannot meet the principle and interest payments on time. It is inevitable because as the volume of money

increases and the resulting increased bidding per unit of production or service rises (price inflation

), industry finds itself having to add more to the selling price

of its output. They pay more for labor and materials and charge more for their products, and it would appear that everything balances out. However this is not so. With larger salary and wage payments there are larger wage withholdings and the necessity for industry to match the withholding. So much out of the employee’s pay must be matched by the employer that this alone increases overhead OUT OF PROPORTION to the allowable price increase on the production.

Taxes are applied with sliding scales and although the manufacturer gets a higher price per unit produced and the yearly monetary numerical total income is higher, raising his tax base, the total number of units produced remains the same, for the same number of employees. The tax base on higher wages is also a sliding scale, the higher the pay, the higher the percentage of tax to be withheld, and the higher the amount to be paid by the employer. So even if the employers were allowed to reflect all wage increases and material costs in price increases — they would still continue to suffer because the sliding scale applied to their tax base would reduce their net income. This is the classic story of our nation since 1966 when the first SUPER EXPANSIONS of created money

began. Industry, faced with SHRINKING NET INCOME at the same time as HIGHER GROSS INCOME, keeps trying new management,

new accounting methods

deferring debt etc., but the longer they hold on

the greater the differential becomes.

With net income shrinking, industry finds it increasingly more difficult to meet its interest burden. All efforts to expand the business only makes it worse. The depreciation taken against equipment in past years cannot possibly buy the updated replacement in the present inflated

economy, because Congress did not allow an inflation

adjusted increase in depreciation allowances. In an effort to get the TAX ALLOWANCE FOR NEW EQUIPMENT PURCHASES industry borrows more money

to expand with and goes deeper in debt with still higher interest burden. Industry finally cannot pay the principle and interest on time and simply has to borrow a LARGER AMOUNT to pay-off

the EXISTING AMOUNT and to get some EXTRA for current expenses.

The gross national product (G.N.P.) is the exchange value of the total amount of goods produced annually expressed in monetary terms (dollars). The G.N.P. keeps increasing as higher prices per unit of production makes the total exchange value higher, even if the number of units remains constant or falls. With a RISING monetary expressed

G.N.P. (false G.N.P.) and a FALLING amount of actual produced units (real G.N.P.), which is the actual case now, eventually even the price increases will not make-up for the lack of production. The REPORTED G.N.P. falls, exposing the truth that the UNITS PRODUCED (real G.N.P.) has been falling rapidly. Official statistics now report a G.N.P.

and a real G.N.P.

The high unemployment rate confirms that the interest burden has finally seriously effected our industrial productive capacity. As the two G.N.P.s (real and false) fall, the total gross and net earnings are falling for mostly all of industry, however, the DEBT and its BURDEN (INTEREST

) are still there and RISING. The debt to assets ratio keeps rising and units of industry begin to collapse. Corporations in existence for over one hundred years find they cannot survive. The G.N.P. falling indicates the whole income producing industrial system is collapsing, the high unemployment rate confirms it.

NON PRODUCTIVE MAKE WORK

JOBS AUTHORIZED BY CONGRESS, TO EASE UNEMPLOYMENT, ARE A DRAIN ON THOSE STILL PRODUCING INCOME AND PAYING TAXES BECAUSE THE MAKE WORK

JOBS DO NOT PRODUCE ANY INCOME AND THEY CONSUME TAXES!

With NET INCOME FALLING, INTEREST on BORROWING and TAXES to pay for unemployment insurance, welfare, etc. RISING, the INEVITABLE COLLAPSE of INDUSTRY is a POSITIVE CONCLUSION.

When government officials see this happening they discuss whether or not to correct the situation by repealing the Legal Tender Act and returning to a 100% reserve system. The Monetary Authority manages to convince them that any exposure of the truth would be an indictment against those in office and that the TRUTH WILL NOT SELL

(buy votes for reelection). Congress is influenced by the Monetary Authority to believe that there is nothing wrong with the system — it just needs some FINE TUNING.

Congress is influenced by the monetary authority to pass laws giving tax breaks

to the sufferers (individuals and income producing corporations). Congress is influenced by the Monetary Authority that an income policy

must be introduced; because if people did not spend their earnings